U.S. labor market has yet to get Powell’s memo

By Howard Schneider

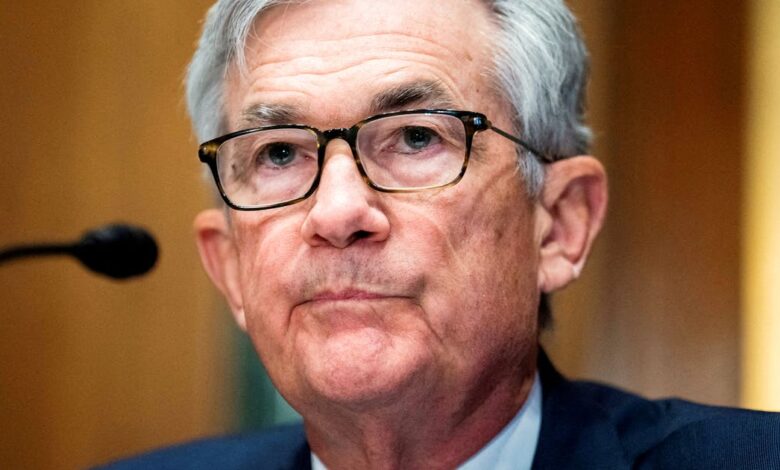

WASHINGTON (Reuters) – Federal Reserve Chair Jerome Powell this week laid out a hoped-for evolution of the U.S. job market that included a rising labor participation charge that will pave the best way for continued job development whereas tapping the brakes on the tempo of wage will increase.

The prospect of extra People getting into the workforce, he advised reporters after the tip of a two-day coverage assembly, would assist the U.S. central financial institution tame excessive inflation with out a big improve in joblessness.

The discharge of the Labor Division’s April nonfarm payrolls report on Friday supplied little fast signal that Powell’s message had been obtained: companies added one other 428,000 jobs, the labor power declined and wages grew at a fast, 5.5% annual tempo.

Nonetheless, economists mentioned the report might present the beginning of the form of adjustment the Fed chief hopes to see:

STRONG JOB GAINS, EASING WAGE GROWTH

When all is alleged and carried out, the Fed needs extra individuals working one month to the following. Regardless of the dialogue about companies struggling to rent, the truth that payrolls rose by greater than 400,000 for a twelfth straight month is a plus.

The acquire introduced the U.S. economic system a step nearer to recovering its pre-pandemic employment degree, with simply 1.2 million remaining positions to succeed in that purpose – and simply 500,000 within the non-public sector. The nation might even get again to its prior development degree subsequent 12 months. Meaning extra family revenue and, all issues equal, a extra resilient economic system.

Graphic- The roles gap going through Biden and the Fed: https://graphics.reuters.com/USA-ECONOMY/JOBS/jbyprzlrqpe/chart.png

Much more to Powell’s liking, the month-to-month tempo of wage development seems to be easing. At a median 0.3% over the past three months, the tempo is the bottom in a 12 months.

“At the moment’s employment report is according to a soft-landing situation. Stable job features … but regardless of that we’re seeing a moderation in common hourly earnings,” mentioned Ellen Gaske, lead economist at PGIM Mounted Revenue. “Now we have unwound the surge that we noticed towards the tip of final 12 months.”

Graphic- Wage development moderates: https://graphics.reuters.com/USA-FED/JOBS/klpyklrglpg/chart.png

PEAK MISMATCH?

Powell has targeted on the outsized numbers of job openings in contrast with the ranks of the unemployed, a mismatch of historic proportions with almost two vacancies for every one that is unemployed.

Gaske believes that’s virtually actually tied to the COVID-related disruptions and the equally disruptive reopening of the economic system.

“Should you wished to open your doorways, you needed to rent someone,” she famous, a scenario that additionally made firms “fairly insensitive to wage will increase.”

At this level, the dynamics could also be shifting, notably with excessive inflation and market volatility resulting in extra warning in relation to hiring plans.

Payroll supplier UKG, which tracks shift work in actual time, famous that in late April, after the Labor Division surveys for that month’s jobs report had been accomplished, demand for employees slipped noticeably in numerous industries, together with retail, logistics and manufacturing.

That might be a harbinger of an imminent slowdown from the common half one million or so jobs gained every month for the reason that begin of 2021 to one thing extra just like the 178,000 monthly seen within the two years earlier than the pandemic.

“What we now have seen is an acceleration to the draw back over the previous couple weeks,” mentioned Dave Gilbertson, vp at UKG.

Moody’s Analytics economist Sophia Koropeckyj projected month-to-month job development would fall to about 200,000 by the tip of this 12 months.

FEWER BODIES

A slight drop within the labor power participation charge final month, to 62.2% from 62.4% in March, together with a decline of almost 400,000 within the variety of individuals both employed or searching for work, was a step backwards.

After regular enchancment in current months, the drop left the economic system’s participation charge nonetheless 1.2 proportion factors beneath the place it was earlier than the pandemic.

Nick Bunker, financial analysis director for Certainly Hiring Lab, mentioned that knowledge must be seen within the context of a current surge in labor provide that has included what he referred to as a “silver lining” within the rising employment charge for these aged 55-64, and features for youthful “prime-age” employees that will see their participation absolutely recovered over the summer time.

Nevertheless it does add a be aware of warning about what’s forward. Fewer our bodies within the job market may imply extra stress on wages slightly than much less. The present unemployment charge of three.6% is traditionally low for the U.S. economic system, and the Fed has struggled up to now to curb inflation with out slowing the economic system a lot that joblessness rises.

Graphic- https://graphics.reuters.com/USA-FED/JOBS/gdpzymnnavw/chart.png

Jefferies economist Aneta Markowska believes the job market at this level is continuous to strengthen and initiatives the unemployment charge will fall to three% by the tip of December, wage development will speed up to six%, and inflation will stay too excessive for the Fed’s liking.

“Beneath the noise, the labor market continues to be sizzling and more likely to get even hotter,” she wrote in an evaluation of Friday’s jobs report.

(Reporting by Howard Schneider; Modifying by Dan Burns and Paul Simao)