Merketmind: Take it easy | SaltWire

A have a look at the day forward in markets from Saikat Chatterjee.

Take it straightforward. That appears to be the message from world markets to policymakers initially of a busy week.

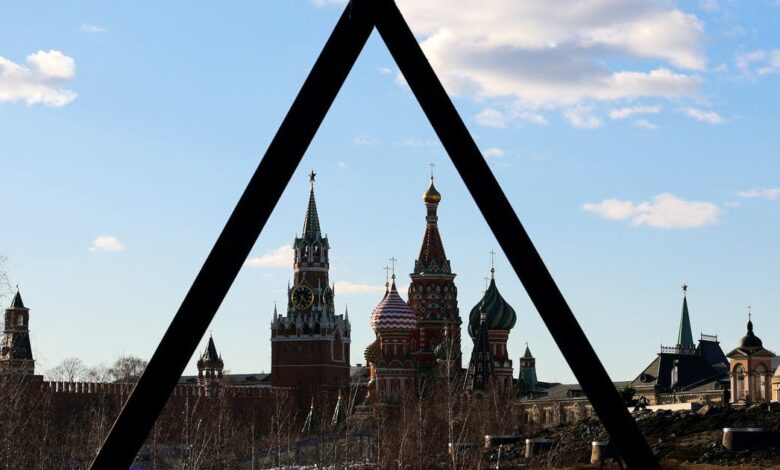

However, with Russia set for a sovereign default and its missiles putting Kyiv for the primary time in weeks, traders will discover it exhausting.

U.S. Federal Reserve officers have stored up their hawkish rhetoric with San Francisco Federal Reserve Financial institution President Mary Daly saying on Friday that one other 75 foundation level rate of interest hike in July is her “place to begin,”. However markets have dialled down bets of aggressive charge hikes.

Fed fund futures contracts rallied in direction of the tip of final week, implying a terminal U.S. rate of interest of round 3.5% by mid-2023, properly under a peak of greater than 4% seen two weeks in the past.

Even a 75 bps charge hike is just not seen as a surefire wager subsequent month as financial information shock indexes in Europe and the US have collapsed in current weeks. Citibank forecasts a close to 50% likelihood of a world recession.

Markets are liking the temper music with world shares extending beneficial properties after posting their greatest single day rise in additional than three months on Friday. The greenback is struggling versus its main rivals and 10-year Treasury yields are hovering round 3.13%, properly under greater than decade highs of three.46%.

There may be loads of occasions this week that may journey up the fledgling rally. First up, the European Central Financial institution’s annual discussion board in Sintra will probably be a key spotlight with ECB President Christine Lagarde and Federal Reserve Chair Jerome Powell each attending the assembly.

Hopes inflation could also be peaking will probably be examined this week when the U.S. PCE worth index, the Fed’s favoured inflation gauge, is out on Thursday and nearer house, the UK will probably be releasing Q1 GDP, present account and last June manufacturing PMI.

And eventually, Russia regarded set for its first sovereign default in many years as some bondholders stated they’d not obtained overdue curiosity on Monday following the expiry of a key fee deadline a day earlier.

Key developments that ought to present extra path to markets on Monday:

Income at China’s industrial corporations shrank at a slower tempo in Could following a pointy fall in April.

Ryanair says lower than 2% of flights affected by strike

Pfizer/BioNTech say Omicron-based COVID pictures enhance response vs that variant

4 of the Group of Seven wealthy nations moved to ban imports of Russian gold to tighten the sanctions squeeze on Moscow.

(Reporting by Saikat Chatterjee)