Stocks slide, dollar spikes as September starts stormy

By Marc Jones and Koh Gui Qing

NEW YORK (Reuters) -September received off to a stormy begin on Thursday, as persistent worries about rising international rates of interest and recessions hounded shares and bonds and drove the safe-haven U.S. greenback to a 24-year excessive towards the yen.

Certainly, information launched early Thursday that confirmed U.S. manufacturing grew steadily in August, as employment and new orders rebounded, was not welcomed by traders, who frightened a powerful economic system strengthens the case for the Federal Reserve to maintain elevating rates of interest within the subsequent few months.

Buyers concern that continued financial coverage tightening by central banks in america and Europe would scupper the 2 regional economies, and set off a recession.

The U.S. S&P 500 index slumped 1%, the Dow Jones Industrial Common fell 0.5%, and the Nasdaq Composite tumbled 2.1%.

A 1.8% fall in Europe’s STOXX share index of 600 corporations helped pushed MSCI’s fundamental world shares index down 1.7% to its lowest since mid-July, whereas Europe’s authorities bond markets noticed extra promoting after their worst month-to-month rout in a long time.

The bearishness was being fed by the chance that the European Central Financial institution will increase its coverage charge by a report 75 foundation factors subsequent week following Wednesday’s report excessive inflation studying.

Heavy shelling at Ukraine’s big Zaporizhzhia nuclear plant rattled nerves, too. Russia had shut its fundamental gasoline pipe to Europe for upkeep, Washington ordered Nvidia Corp to cease promoting high-tech chips to China, whereas veteran investor Jeremy Grantham warned of an “epic finale” to the inventory market “superbubble” inflated by years of low cost cash.

“The entire world is now fixated on the growth-reducing implications of inflation, charges, and wartime points such because the power squeeze,” Grantham stated.

Add to that COVID-19 in China, meals and power crises, demographics and local weather change and “the outlook is way grimmer than may have been foreseen,” he added.

The dive for security noticed the greenback advance to a brand new 24-year excessive of 140.21 yen in forex markets as traders braced for increased U.S. charges, whereas anticipating anchored Japanese charges to go nowhere anytime quickly.

The euro tumbled 1.1% towards a surging greenback to $0.99425, sterling fell 0.7% to $1.15360, whereas the risk-sensitive Australian and New Zealand {dollars} drooped to their lowest ranges since July. [FRX/]

Hawkish Fed expectations noticed Treasury yields hit recent highs. The yield on benchmark two-year notes jumped to three.5510% to the very best since late 2007, whereas the yield on 10-year bonds rose to a excessive of three.2970%.

Bets on a bumper ECB transfer subsequent week had been gaining traction, too. Euro zone cash markets had been now pricing in a roughly 80% probability of an unprecedented 75 foundation level hike, up from 50% earlier within the week. [GVD/EUR]

Benchmark German Bund yields, that are a key driver of borrowing prices, went above 1.63% earlier than pulling again to 1.57%. Italy’s 10-year bond yield climbed to its highest since mid-June at 4% at one level, and the closely-watched hole between German and Italian bond yields expanded to its widest since late July.

“The ECB’s September eighth assembly remains to be an in depth name, however this newest information will probably be sufficient to tip even the centrist members in the direction of a 75 foundation level hike,” Mizuho analysts stated.

HEAVY METALS

Markets are awaiting U.S. non-farm payrolls information on Friday and so they might not like a powerful quantity if it helps the idea for a continuation of aggressive charge hikes, which may additional enhance the U.S. greenback.

In a single day, Cleveland Fed President Loretta Mester stated the U.S. central financial institution would want to spice up rates of interest considerably above 4% by early subsequent yr and maintain them there so as to convey inflation again all the way down to the Fed’s aim. She additionally warned that the dangers of recession over the following yr or two had moved up.

Credit standing businesses had been allotting warnings as nicely. Moody’s slashed its forecast for the world’s high 20 economies to 2.5% progress from 3.1%, whereas Fitch acknowledged the euro zone was now set for recession.

“A full shut-off of Russian pipeline gasoline to the EU more and more appears to be like like an affordable assumption,” Fitch’s Brian Coulton stated, including that the hit to progress already seen meant a recession was clearly beginning.

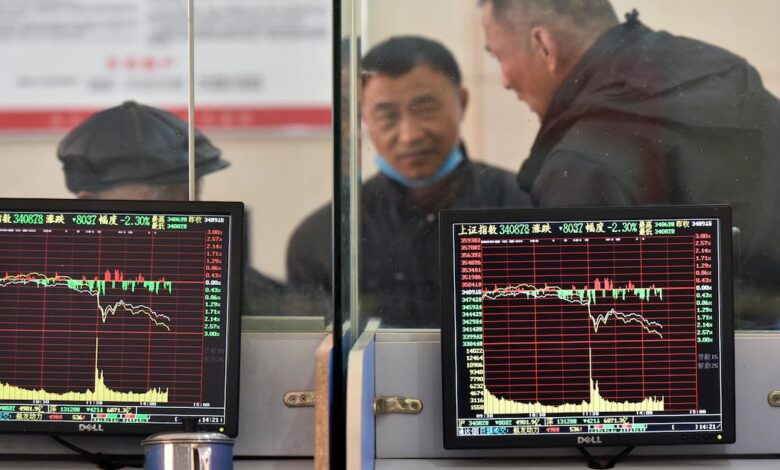

Asian shares slid in a single day in addition to traders there additionally bought the whole lot dangerous that was not nailed down.

Japan’s Nikkei skidded 1.5% and Hong Kong’s Hold Seng index fell 1.8%, whereas Chinese language blue-chips ended down 0.9% having been anchored earlier within the session by hopes for extra financial stimulus from Beijing.

Regional buying managers’ indexes from South Korea, Japan and China on Thursday had all pointed to slowing international financial exercise as rising rates of interest, excessive inflation, the battle in Ukraine and China’s COVID curbs took a heavy toll.

“August has been a horrible month for stability fund traders with no diversification beneficial properties from holding a portfolio of equities and bonds,” Rodrigo Catril, senior FX strategist at Nationwide Australia Financial institution, stated in a be aware to purchasers.

“Month finish yields no surprises, however relatively an extension of the main themes seen throughout August with additional will increase in core international bond yields and weaker equities.”

In the primary commodity markets, Brent crude declined 3% to $92.67 per barrel, as stories of latest COVID-19 lockdown measures in China added to issues about softening demand. U.S. crude fell 2.9% to $87.01 a barrel, though European gasoline costs did present some aid as they fell again 4% as markets received used to Russia’s provide lower.

Gold fell 1% to $1,694.58 an oz [GOL/], however industrial metals all took a heavy pounding with tin down 8%, zinc down 5.3% and copper down 1.75%.

(Further reporting by Reporting by Stella Qiu in Sydney; Modifying by Kirsten Donovan and Jonathan Oatis)