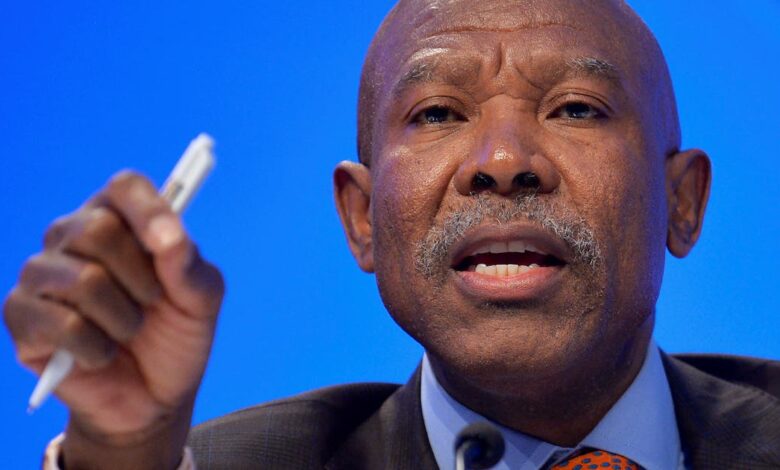

South African central bank governor’s comments on rate decision

JOHANNESBURG (Reuters) – Under are some quotes from South African Reserve Financial institution Governor Lesetja Kganyago as he introduced the central financial institution’s newest rate of interest resolution on Thursday.

INFLATION

Whereas financial progress is slowing globally, inflation continues to shock to the upside. Sustained coverage lodging, provide shortages and different restrictions have sharply elevated the costs of many items, companies and commodities.

Producer worth will increase proceed to pass-through to wages and shopper costs globally. Our estimate for inflation within the G3 is revised greater to 7.0% in 2022 (from 6.9%), as much as 3.5% in 2023 (from 3.0%), and barely greater at 2.1% in 2024.

Regardless of diminished world meals worth inflation, native meals worth inflation is revised up and is now anticipated to be 8.1% in 2022 (up from 7.4%). Meals worth inflation is revised decrease to five.6% (down from 6.2%) in 2023 and stays unchanged at 4.2% in 2024.

The Financial institution’s forecast of headline inflation for this 12 months is unchanged at 6.5%. For 2023, headline inflation is revised decrease to five.3% (down from 5.7%), on account of decrease meals, gasoline and core inflation forecasts for subsequent 12 months.

Headline inflation of 4.6% is predicted in 2024 (down from 4.7%).

Our forecast for core inflation is unchanged at 4.3% in 2022, and decrease than beforehand anticipated at 5.4% (down from 5.6%) in 2023. The forecast for 2024 can also be barely decrease at 4.8% (from 4.9%). Companies worth inflation is broadly unchanged.

Core items worth inflation nevertheless is forecast decrease in every year, largely on account of a decrease place to begin for automobiles and non-alcoholic drinks inflation.

The dangers to the inflation outlook are assessed to the upside. Whereas world producer worth and meals inflation has eased, Russia’s battle within the Ukraine continues, with adversarial results on world costs.

Common surveyed expectations of future inflation have elevated to six.5% for 2022 and 5.9% for 2023.

ECONOMIC GROWTH

This 12 months the South African Reserve Financial institution expects the South African economic system to develop by 1.9%, (from 2.0%).

Progress within the first quarter of this 12 months shocked to the upside, at 1.7%. Within the second quarter, flooding in Kwa-Zulu Natal and extra in depth load-shedding contributed to a contraction of 0.7%.

Progress within the third and fourth quarters is forecast to be 0.4 and 0.3%, respectively.

The economic system is forecast to develop by 1.4% in 2023 and by 1.7% in 2024, above earlier projections.

With a low fee of potential, our present progress forecast leaves the output hole broadly unchanged. The output hole remains to be anticipated to show optimistic within the second quarter of 2023.

DECISION

Towards this backdrop, the MPC determined to extend the repurchase fee by 75 foundation factors to six.25% per 12 months, with impact from the 23 rd of September 2022.

Three members of the Committee most popular the introduced enhance. Two members most popular a 100 foundation factors enhance.

The extent of the repurchase fee is now nearer to the extent prevailing earlier than the beginning of the pandemic.

The revised repurchase fee path stays supportive of credit score demand within the close to time period, whereas elevating charges to ranges extra according to the present view of inflation dangers.

The goal of coverage is to anchor inflation expectations extra firmly across the mid-point of the goal band and to extend confidence of hitting the inflation goal in 2024.

Guiding inflation again in the direction of the mid-point of the goal band can cut back the financial prices of excessive inflation and allow decrease rates of interest sooner or later.

(Compiled by James Macharia Chege)