Online scams: Most common types and how to avoid falling for them

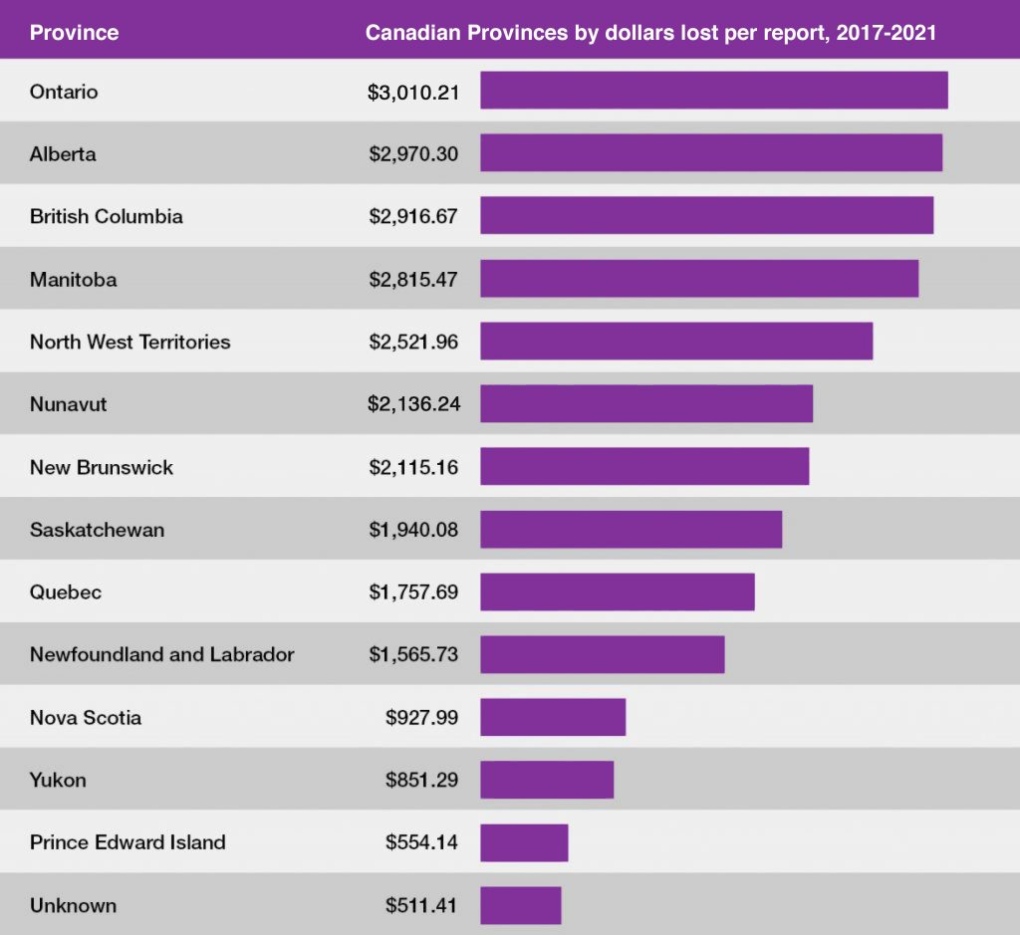

British Columbians are amongst those that lose essentially the most cash on common to scams.

A just-published research means that victims in B.C. lose a mean of about $3,000 – an identical sum to what’s seen in Ontario and Alberta.

In keeping with the study from Social Catfish, which used knowledge from the Canadian Anti-Fraud Centre collected over the past 5 years, B.C. victims lose the third-most amount of cash on common.

That common, the group stated, is $2,916.67, down barely from the $3,010.21 Ontarians lose, and from $2,970.30 in Alberta.

The province or territory the place victims have misplaced the least amount of cash is Prince Edward Island, the place the common is $554.14.

The research didn’t counsel which means residents of these provinces are roughly tech-savvy, and with regards to reported complaints, B.C. was sixth.

In keeping with Social Catfish, the speed of CAFC complaints in B.C. is 249 per 100,000 residents. Manitoba really had the very best fee of reported rip-off victims, adopted by Ontario and Yukon.

(Social Catfish)

(Social Catfish)

DETAILS AND ADVICE

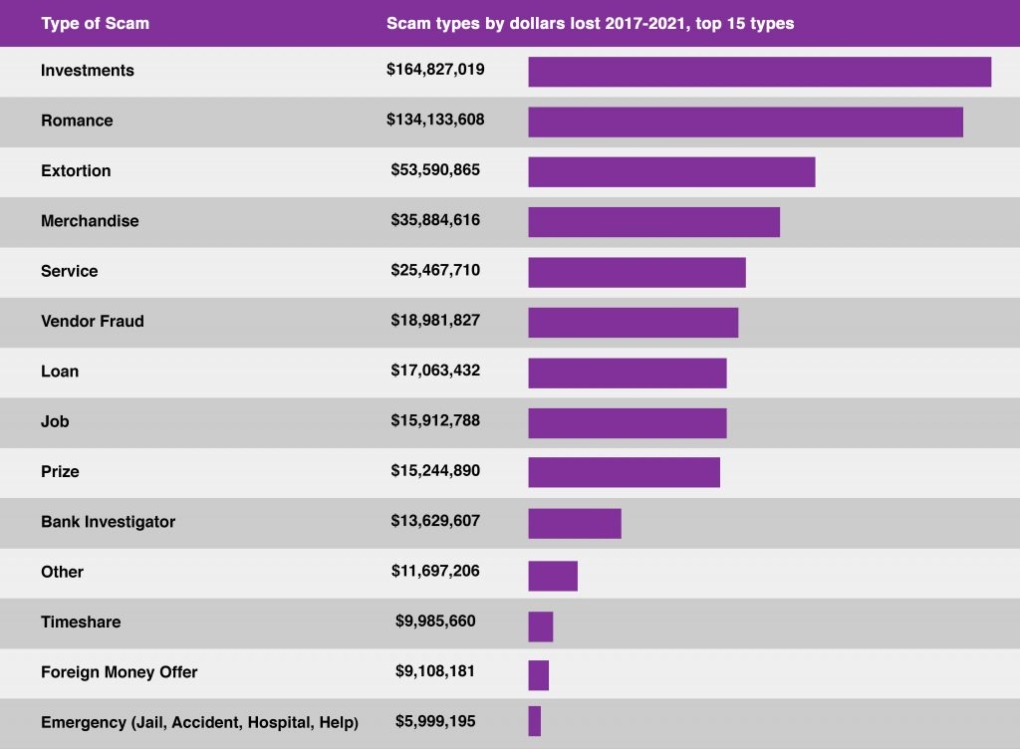

As for the way fraudsters are tricking their victims, the commonest rip-off in Canada includes funding. Canadians misplaced a whopping $165 million between 2017 and 2021 to alternatives billed as once-in-a-lifetime, can’t-miss offers.

These scams are sometimes despatched by e mail or social media, and promise a excessive fee of return for little threat. The would-be investor transfers cash, then by no means sees it once more.

Typically these scams contain cryptocurrency akin to Bitcoin.

As for tips on how to keep away from falling for it, consultants advise these approached to analysis the particular person or firm, and seek the advice of a third-party monetary advisor.

The second most-costly scams prey on a unique emotion: love.

Canadians misplaced $134 million to romance scams within the five-year interval concerned within the research. Scammers concerned in these will use social media or courting apps to strategy their victims and earn their belief, then begin faking emergencies.

They ask for cash, get as a lot as they will from the goal, then disappear.

To guard your self, consultants advise, refuse to provide cash to anybody not keen to fulfill in particular person or use video chat.

One other tip is to save lots of the photograph or pictures the particular person is utilizing and run them by means of a reverse picture search, to see if the pictures are their very own. To do that, go to Google Images in an online browser and add the picture or photos by clicking the digital camera icon within the search bar, then look by means of the outcomes.

And one other $54 million was misplaced throughout the identical interval to extortion scams. These embrace emails and cellphone calls from “police” or related businesses accusing the goal of great legal offences.

Scammers will inform the sufferer to reply to a pretend e mail handle in the event that they wish to keep away from jail time, then ask for cash and different private data.

Police and different legislation enforcement businesses won’t ever demand money or threaten to make an arrest by cellphone or e mail, so potential victims could be assured that these approaches are pretend.

(Social Catfish)

(Social Catfish)

WHO ARE THE VICTIMS?

In keeping with the research, essentially the most susceptible age group is 60 to 69.

In a breakdown of {dollars} misplaced by age group to romance scams particularly, this was nonetheless true, however folks between the ages of 40 and 59, in addition to 70 to 79, additionally misplaced important quantities of cash, and other people of their 30s and 80s weren’t that far behind.

The common loss by all Canadians to those scams was about $54,000, however some had been extra doubtless than others.

Based mostly on CAFC knowledge, victims beneath 20 misplaced a mean of $2,631.26, and victims over 90 misplaced $4,348.97.

Victims of their 60s misplaced essentially the most, at $81,384.76, adopted by folks of their 40s who had been scammed out of practically $79,000.

In keeping with the CAFC, there had been 29,294 reviews of all sorts of fraud involving 18,609 victims this 12 months, as of the top of April. These victims misplaced roughly $163.9 million.

(Social Catfish)

(Social Catfish)