CHARLEBOIS AND TAYLOR: Dealing with ‘Greedflation’

Article content material

Accusations of gouging within the meals trade have reached an all-time excessive. Based on a current survey, 68% of Canadians consider meals firms are benefiting from the inflationary cycle to extend costs, and it’s not simply in retail. Whereas each Quebec and British Columbia now have class-action lawsuits in opposition to the meat trade, many commerce teams and politicians are actually asking the federal authorities to analyze.

Commercial 2

Article content material

We’ll hear complaints from shoppers about costs being exaggeratedly inflated in several sectors, corresponding to automotive, telecommunications, prescribed drugs, and airways. However meals is totally different. The stakes are totally different for everybody. The stability between income and profiteering is extremely delicate. Together with power, meals is essentially the most risky component when measuring inflation, basically resulting from how the class is definitely affected by climate, labour and geopolitics. Half of the merchandise you see in a grocery retailer are perishable and depend on chilly chains. That side alone of the enterprise makes issues extra sophisticated than transferring automotive elements or wooden round. Getting meals from farm to retailer, or to restaurant, is a battle of time and stress, every single day. Failure means extra waste, extra issues, extra prices, and better meals costs.

Commercial 3

Article content material

It’s straightforward guilty meals corporations; it’s populist, actually. Grocers get a lot of the backlash from shoppers resulting from their publicity. In current weeks, many have criticized grocers for recording traditionally excessive income, and accused them of taking benefit of the present inflationary cycle. Grocers have been determined to be forward of the market and beat the unpredictable nature of what’s taking place. When carrying 18,000 to twenty,000 merchandise, it’s not that easy. Wanting on the monetary efficiency of our three largest grocers, the numbers have been constant for essentially the most half.

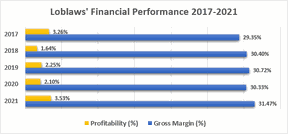

Our largest grocer, Loblaws, has posted constant gross margin and revenue ratios since 2017. Whereas gross margins have diverse between 29.35% and 31.47%, income are anyplace between 1.64% and three.53%. For Empire/Sobeys and Metro, the outcomes are related. Gross margins for Empire/Sobeys diverse between 23.97% (2017) to 25.47% (2021) and income from 0.67% (2017), to 2.48% (2021). For Metro, related variations aside from 2018, when profitability was at 11.93%. That was possible resulting from Metro’s acquisition of Jean Coutu. Acquisitions will skew how these corporations carry out financially, and we’ve seen many acquisitions lately. That is one thing we’d like to bear in mind.

Commercial 4

Article content material

Certainly, income and margins are greater, however ever so barely. In comparison with some banks and different main financial gamers in our economic system, the distinction is comparatively small. We additionally must needless to say many Canadians will profit from these respectable monetary outcomes as most pension plans in Canada will personal shares in at the least one of many huge three.

The actual fact stays that any proof of “greedflation” in meals retail in Canada is weak at greatest. That mentioned, some costs in some meals classes have behaved unreasonably lately, so it doesn’t imply “greedflation” doesn’t exist. Accepting that “greedflation” exists and accusing corporations of being abusive, although, is the simple half. The place it will get difficult is to set thresholds. How a lot is an excessive amount of? The place’s the road between good enterprise observe and greed? Some shoppers are nonetheless willingly paying $28 for steaks on the grocery retailer, pushing costs greater for the remainder of us.

Commercial 5

Article content material

Additional investigation could be warranted. Different hyperlinks of the availability chain are tougher to investigate, since many corporations are privately owned, and contracts should not public. And shoppers have each proper to be uncertain, contemplating that we’ve seen our share of price-fixing scandals lately. The bread price-fixing scheme is only one instance. Everybody would achieve from wanting on the extra obscure sectors of the meals trade, past retail, to raised perceive how our meals provide chain works. A government-led inquiry would profit us all, however the focus would should be narrowed. The meals trade is simply too huge of a market to make any evaluation worthwhile.

It’s additionally value noting that the proportion of client expenditure spent on meals consumed at residence is without doubt one of the lowest on the planet in Canada. Based on the World Financial Discussion board, the common client spends 9.1% of a complete funds on meals. In the USA, it’s about 7%. In 1950, that proportion was over 30%, so we’ve come a great distance.

Commercial 6

Article content material

Meals inflation will peak quickly in Canada, or it could have peaked already. Meals costs will proceed to rise, however at a a lot slower tempo within the coming months. The 12 months 2022 was to be the 12 months of restoration from the pandemic, however Russia had different plans. It’s necessary to needless to say meals inflation is a traditional financial phenomenon. So as to correctly equip the trade in a approach that Canadians get high quality merchandise at constant pricing, costs ought to proceed to rise. In current months although, it’s been unsustainable for a lot of households. Meals inflation’s preferrred fee is between 1.5% and a couple of.5%, which is what we’ve been getting for the final 20 years or so, aside from this previous 12 months.

Canadians do have a powerful meals trade, however meals affordability has been a problem for many people. However we have to take a look at “greedflation” rationally earlier than slinging mud at every thing and something.

Sylvain Charlebois (sylvain.charlebois@dal.ca) is Director, Agri-Meals Analytics Lab, Dalhousie College, and Samantha Taylor (samantha.taylor@dal.ca) is a Professor in Accounting, Rowe College of Enterprise, Dalhousie College.