BMO tells Canadian Real Estate Investors to Buckle Up

As we wrap up this loopy 12 months and head right into a extremely unsure 2023, BMO Capital Markets tries to offer some steerage for actual property traders with their 2023 Canadian actual property outlook.

They begin off the notice by reassuring traders that the Canadian financial system is probably going getting into a recession in 2023, saying that the Financial institution of Canada’s efforts in making an attempt to get inflation again right down to 2% will drive the slowdown. Their market financial analysis group requires “two consecutive quarters of actual GDP contraction within the first half of 2023.”

They imagine that traders’ expectations ought to be extra tempered for 2023 as they imagine there are lots of causes for property valuations to be “tilted to the draw back.” They level to the turbulent yield curves as taking part in the most important function within the uncertainty that lies inside lots of sectors, particularly actual property. Noting that Canada and the U.S. got here into 2022 with “ultra-low charges” for each quick and long run, now exiting 2022 with above common charges, wreaking havoc on the bond market.

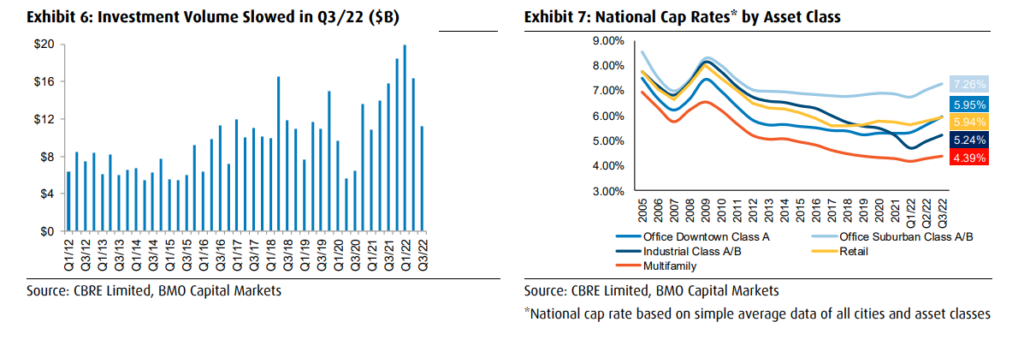

On account of this outsized transfer in rates of interest by the central banks, funding exercise within the personal markets has dropped like a rock. In accordance with CBRE, the whole quantity has seen two consecutive declines, with the whole quantity being down 44% peak to trough to $11.3 billion within the third quarter of 2022.

Demand destruction will not be the one factor greater rates of interest have impacted for actual property patrons. Costlier debt because of the charge hikes can also be affecting demand. In accordance with CBRE, the nationwide common cap charges have elevated by 20bps on the low finish and 60bps on the excessive finish from the primary quarter to the third quarter of this 12 months. Whereas BMO believes that charges will proceed to be pushed greater because the rate of interest hikes move by way of the system and keep excessive for an extended time frame.

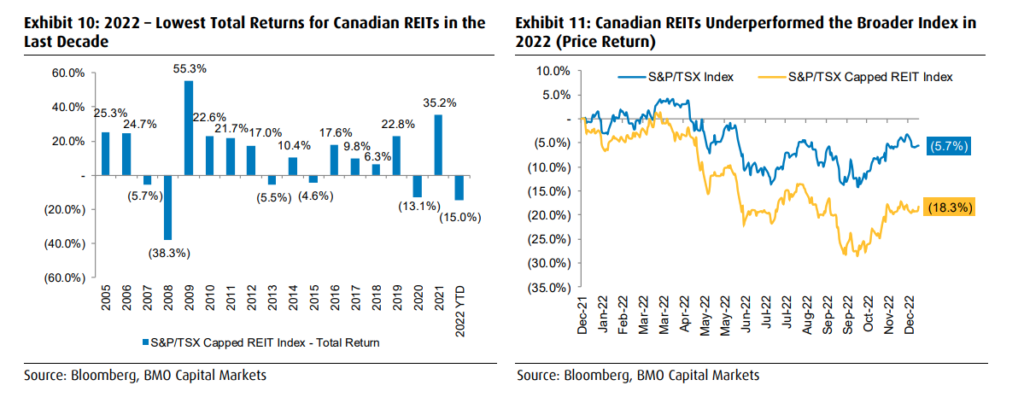

2022 is shaping as much as be the worst 12 months for actual property funding trusts since 2008 BMO says. The year-to-date return for the S&P/TSX Capped REIT Index was down 15%, whereas the index was down 13.1% in 2020. BMO says whereas the sector is arguably due for a bounce,” they imagine that even when one have been to occur, it could be a really weak bounce.

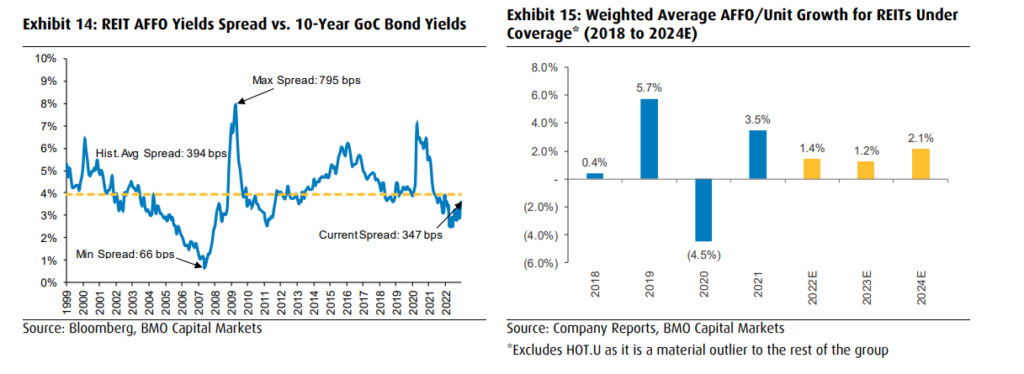

For the explanations mentioned above, BMO believes that the traditionally excessive weighted common low cost to NAV of -11.4% will proceed to develop as corporations proceed to make revisions to it. Additionally they add that the AFFO yield unfold (Adjusted Funds from Operations Yield), which is the same as 6.3% for BMO’s protection, is simply 3.47% greater than the 10-year authorities bond. The unfold between the 2 often is way greater anytime the sector has traded at a “materials low cost to NAV.”

On a extra bullish notice, BMO factors to immigration. The nationwide inhabitants progress has exceeded the pre-pandemic peak, with the most recent numbers saying that Canada’s inhabitants has elevated by 285,980 within the second quarter of 2022. With the variety of residents added for the 12-month endings July 1st, 2022 was 703,400.

They are saying that probably the most important will increase have been in six particular provinces, New Brunswick, Nova Scotia, Newfoundland, Prince Edward Island, Alberta, and British Columbia. They write, “In these areas, sturdy worldwide immigration has been augmented by accelerating internet inflows as a consequence of relocations from different areas of Canada.”

Lastly, BMO says that regulatory issues ought to be on the high of their minds for multi-family traders. Pointing to Prime Minister Justin Trudeau’s letters, which informed the Minister of Finance, Chrystia Freeland and the Minister of Housing and Range and Inclusion, Ahmed Hussen, to do many issues.

It contains modifications to the Earnings Tax Act requiring landlords to reveal pre- and post-renovation lease acquired of their tax filings and to pay a surtax if the lease enhance “is deemed extreme” and to overview and contemplate attainable reforms to the present tax therapy of REITs. BMO factors to the ever-increasing scrutiny of the financialization of housing.

Info for this briefing was discovered through Edgar and Refinitiv. The writer has no securities or affiliations associated to this group. Not a advice to purchase or promote. All the time do extra analysis and seek the advice of knowledgeable earlier than buying a safety. The writer holds no licenses.