Japan Finance Minister makes most explicit warning yet against yen slump, economic fallout

By Tetsushi Kajimoto

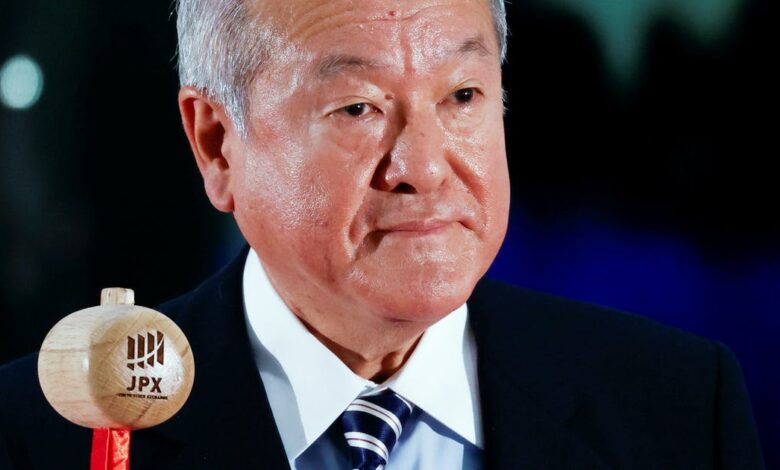

TOKYO (Reuters) -Japanese Finance Minister Shunichi Suzuki mentioned on Tuesday the injury to the economic system from a weakening yen at current is bigger than the advantages accruing to it, making probably the most specific warning but in opposition to the foreign money’s current droop versus the greenback.

The yen’s fall has worsened imported inflationary pressures in Japan amid a spike in international commodity and oil prices, and a rise in provide snags, which have intensified within the wake of the Ukraine disaster.

“Stability is vital and sharp foreign money strikes are undesirable,” Suzuki instructed parliament, repeating earlier feedback because the Japanese foreign money weakened to contemporary 20-year lows on the greenback.

“A weak yen has its benefit, however demerit is bigger underneath the present scenario the place crude oil and uncooked supplies prices are surging globally, whereas the weak yen boosts import costs, hurting shoppers and corporations which can be unable to cross on prices,” Suzuki mentioned.

Taken collectively, the minister’s feedback marked the clearest sign about Japanese authorities’ discomfort over the yen’s continued decline.

Suzuki declined to touch upon how the federal government and the Financial institution of Japan ought to reply to the yen’s weakening, together with whether or not intervening out there is an choice.

His remarks got here earlier than his journey to Washington to attend a gathering of economic leaders from the Group of 20 (G20) main economies this week. Among the many many discussions, the minister can also be scheduled to a maintain a gathering with U.S. Treasury Secretary Janet Yellen.

Suzuki vowed to stay to Group of Seven (G7) superior economies’ settlement on currencies and intently talk with U.S. and different international locations’ foreign money authorities to “reply appropriately” to foreign money actions.

The foreign money market shrugged off the minister’s verbal jawboning, sending the yen to 127.80 to the greenback, its lowest stage since Could 2002. The yen has misplaced about 10% in opposition to the greenback thus far this yr.

Buyers say verbal warnings will not have a lot of an affect because the yen’s weak point displays fundamentals, noting contrasting prospects for an aggressive streak of Federal Reserve tightening with that of the Financial institution of Japan’s dedication to take care of its highly effective financial easing plan.

G7’s basic stance is that foreign money charges are set by the market and that members will intently seek the advice of with one another on any motion within the overseas trade market. The group additional acknowledges that extra volatility and disorderly strikes can adversely have an effect on financial and monetary stability.

Japanese authorities had been fastidiously watching how the weakening yen might have an effect on the economic system, as stability within the foreign money market is vital, Suzuki added.

An April 1-11 ballot of 5,400 Japanese corporations carried out by non-public credit score analysis agency Tokyo Shoko Analysis confirmed roughly 40% suffered a unfavorable affect from a weak yen, with assumed greenback/yen charges being as little as 110 yen amongst listed producers.

The earlier ballot in December, when the greenback was transferring round 113 yen, discovered solely about 30% of Japanese corporations noticed a weak yen as unfavorable, underscoring how the fast depreciation because the begin of this yr is hitting firms.

(Reporting by Tetsushi KajimotoEditing by Shri Navaratnam and Kim Coghill)