Rogers falls as massive outage raises concerns over Shaw deal

Article content material

Shares of Rogers Communications Inc and takeover goal Shaw Communications fell on Monday as analysts voiced issues over elevated threat to the C$20 billion ($15.4 billion) deal following final week’s 19-hour Rogers outage.

Commercial 2

Article content material

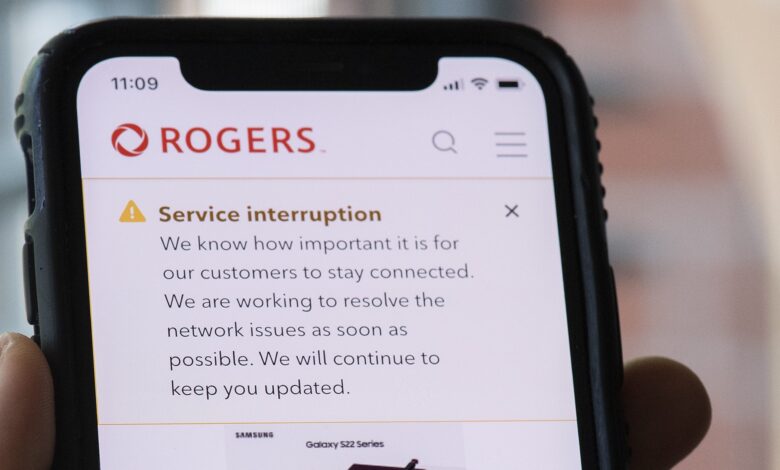

Rogers suffered an unprecedented outage on Friday that affected practically each aspect of day by day life in Canada as entry to web and telephone companies, each cellular and landline, was reduce off. Some callers couldn’t attain emergency companies by way of 911 calls, police throughout Canada stated.

On Monday, Canadian fee gateway Interac stated it was including one other community supplier to its system after the Rogers outage left tens of millions of Canadians locked out of on-line funds.

Article content material

“We’re including a provider (in addition to Rogers) to strengthen our present community redundancy so Canadians can proceed to depend on Interac day by day,” Interac stated in a press release.

Rogers’ Canadian-listed shares fell 4.6% and Shaw dropped 4.3% to C$34.67, whereas the benchmark Canadian share index ended down 1.2%. Rogers has provided C$40 per Shaw share.

Commercial 3

Article content material

The likelihood of the deal closure dropped to about 62% on Monday from 88% every week in the past, in response to merger arbitrage merchants.

“The incident is prone to introduce incremental regulatory threat to the Shaw transaction,” BMO analyst Tim Casey stated, including that it could additionally elevate investor issues over Rogers’ means to execute on deal synergies.

Business Minister François-Philippe Champagne was anticipated to fulfill on Monday with chief executives of Rogers, BCE Inc and Telus Corp, which management 90% of Canada’s telecommunications market, to debate how you can enhance community reliability throughout the nation.

“This isn’t nearly checking off a field. The minister could have some concepts and, hopefully, some options will come out of it,” stated a ministry official, who didn’t want to be quoted as a result of sensitivity of the difficulty.

Commercial 4

Article content material

The ministry has the ultimate say on the deal.

“We very a lot stay dedicated to the Shaw transaction,” Rogers CEO Tony Staffieri advised BNN Bloomberg Tv on Monday. “That transaction has all the time been about increasing our community capabilities, attaining extra redundancy and protection throughout the nation that may solely assist in conditions like this,” he added.

Friday’s disruption got here two days after Rogers held talks with Canada’s antitrust authority to debate attainable cures to its blocked takeover of Shaw.

Canada’s competitors bureau blocked the deal earlier this 12 months, saying it could hamper competitors in a rustic the place telecom charges are a number of the world’s highest.

Rogers’ second outage in 15 months has led customers and politicians to name on the federal government to permit extra competitors within the sector.

Commercial 5

Article content material

Rogers on Saturday stated its companies have been shut to completely operational and narrowed the trigger to a community system failure following a upkeep replace.

A analysis observe by Scotiabank estimated Rogers must credit score between C$65 million to C$75 million to clients within the third quarter as a result of outage.

Rogers had a web earnings of C$1.56 billion in 2021.

Scotiabank analysts additionally stated elevated political and regulatory threat is a chance after the outage.

The oversight must steadiness the chance of future failures in opposition to the elevated client/financial prices in constructing different parallel networks, they added.