Company Profile: Power Nickel | the deep dive

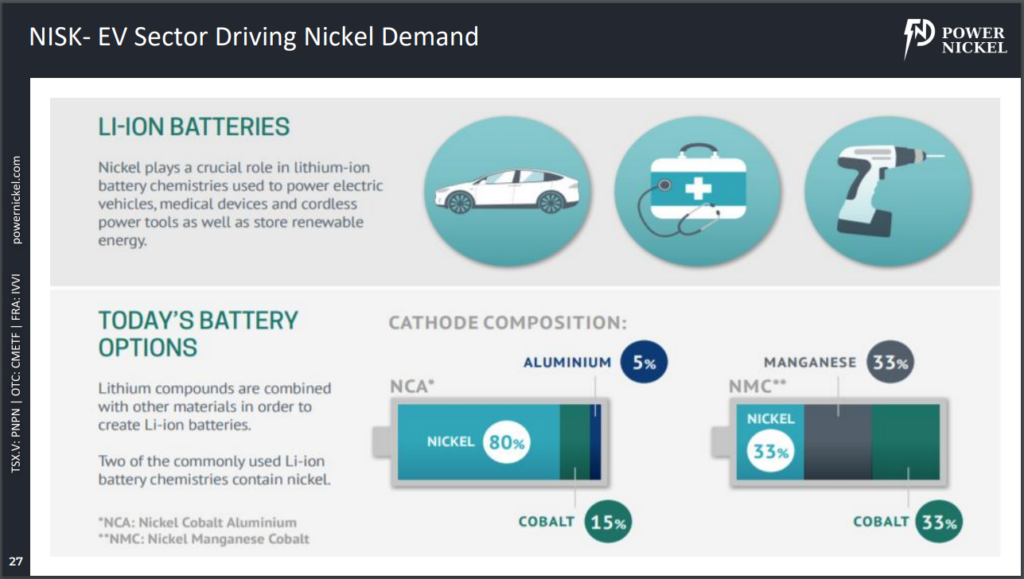

Energy Nickel (TSXV: PNPN) is creating its flagship Nisk high-grade nickel mission within the James Bay area of Quebec close to the city of Nemaska. The 20 kilometre lengthy Nisk property consists of two blocks totaling 90 claims that cowl a big land place of 45.9 sq. kilometres. The corporate is targeted on supplying uncooked supplies for the quickly increasing electrical car (EV) trade and the batteries required to energy them. Nickel is an more and more necessary part within the manufacturing of lithium-ion batteries, in addition to renewable vitality applied sciences.

Previously often called Chilean Metals, the corporate additionally nonetheless holds an curiosity in three Chilean copper properties via its 100% owned Consolidation Gold & Copper subsidiary. Consolidation additionally holds a 100% curiosity within the Golden Ivan property situated in British Columbia’s prolific Golden Triangle area. So as to focus solely on battery metals, the agency is within the course of to spin out Consolidation Gold & Copper as a separate public exploration firm to Energy Nickel shareholders, who will then personal shares in each corporations.

The Funding Thesis

We base our funding thesis on the next elements:

- Energy Nickel is aiming to grow to be a number one provider of Class-1 nickel.

- The Nisk mission advantages from properly established infrastructure within the area.

- Mining-friendly Quebec is attempting to advertise a homegrown electrical car and battery trade.

- Energy Nickel will spin off its British Columbia and Chile belongings right into a separate public firm.

- The corporate has an skilled administration staff with in depth mining and public firm expertise.

The Deep Dive views Energy Nickel Inc. as a battery metals firm with a doubtlessly world-class nickel asset. We view Energy Nickel as having upside potential because of the rising demand for prime quality nickel and different battery metals. If the exploration exercise advances the Nisk mission to pre-feasibility, it may doubtlessly grow to be a pretty takeout candidate for a significant mining firm, and supply shareholders with a profitable windfall. The mission itself will profit as a home nickel provider to Quebec’s rising EV and battery industries, if the agency is ready to get the property to the manufacturing stage.

The Huge Image

The present world macro setting supplies a bullish catalyst for the demand for nickel, cobalt, lithium, and different minerals utilized in lithium ion batteries for the electrical car trade. In accordance with Bloomberg’s 2020 New Energy Finance study, it’s anticipated that by 2050, electrical automobiles will account for 65% of worldwide passenger car gross sales by 2050.

China has the most important share of the worldwide electrical car market and the Chinese language authorities is aggressively selling the shift to EVs to scale back its dependence on vitality imports and to scale back its air air pollution. European nations are additionally actively selling a transfer away from gasoline-powered automobiles because the continent continues its shift to renewable vitality applied sciences to fulfill carbon emission requirements and obtain carbon neutrality by 2050.

We anticipate the battery minerals market to develop considerably because of persevering with progress of the electrical car market attributable to a worldwide shift to renewable vitality sources, and continued enchancment in battery applied sciences. In accordance with mining large Glencore, it’s estimated that demand from the EV trade will devour 59% of all nickel manufacturing output by 2030. EVs require high-purity (99.8%) Class-1 nickel, subsequently this bodes very properly for nickel explorers akin to Energy Nickel, who may doubtlessly grow to be grow to be a number one provider.

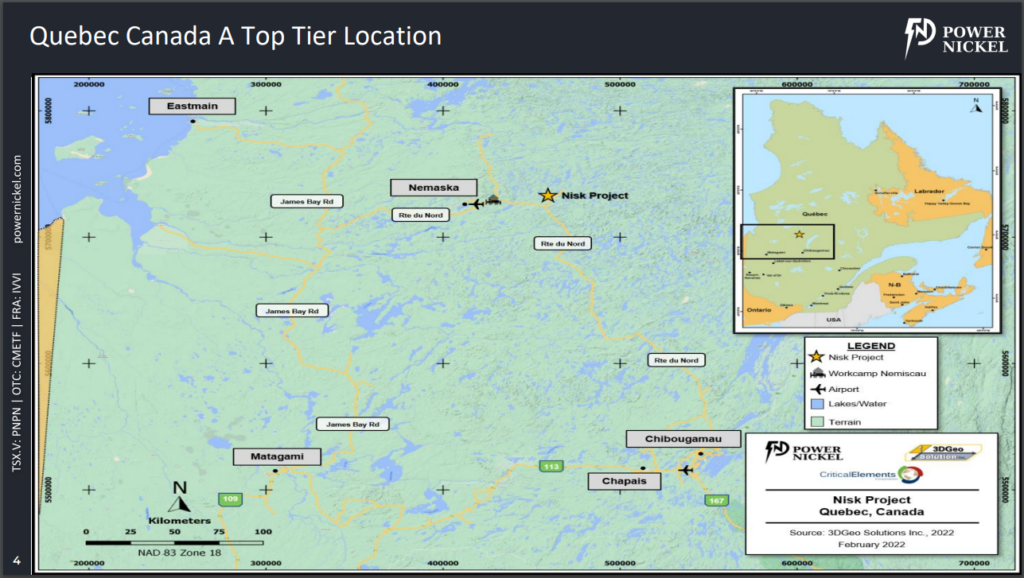

The Nisk Nickel Sulfide Challenge

The Nisk property is situated within the James Bay area of Quebec close to the city of Nemaska. The property consists of two blocks totaling 90 claims, that cowl a big land place of 45.9 sq. kilometres. The property itself is hosted inside the Lac des Montagnes volcano-sedimentary formation that underlies a big a part of this area.

The area has glorious infrastructure because of the proximity of the James Bay Hydroelectric plant and a highway community that was constructed to assist the native communities and former mining exploration actions within the space. The Nisk mission is accessible by highway and an influence line cuts throughout the property, enabling Energy Nickel to learn from the provision of low-cost, low-carbon electrical energy..

Historic exploration of the property recognized quite a few high-grade intercepts of Class-1 Nickel, which is very wanted and comparatively uncommon. The property additionally has a wide range of battery metals mineralization, together with copper, cobalt, palladium, and platinum.

Nisk is taken into account to be a nickel sulfide deposit and a attribute of nickel sulfide deposits discovered around the globe is that they seem as pods. This appears to be the case on the Nisk property, the place there are a sequence of pods that the corporate describes as “a string of pearls,” alongside the strike size of the property. Earlier drilling signifies that mineralization is open alongside strike and at depth, and because of the measurement of the property, Nisk has the potential to be one of many greenest sources of class-1 nickel on the planet whereas additionally containing different battery metals.

Though not NI 43-101 compliant, a 2009 technical report on the property confirmed historic assets of the next.

- Measured – 1,255,000 tonnes of 1.09% nickel, 0.56% copper, 0.07% cobalt, 1.11 g/t palladium, and 0.20 g/t platinum.

- Indicated – 783,000 tonnes of 1.00% nickel, 0.53% copper, 0.06% cobalt, 0.91 g/t palladium, and 0.29 g/t platinum

- Inferred – 1,053,000 tonnes of 0.81% nickel, 0.32% copper, 0.06% cobalt, 1.06 g/t palladium, and 0.50 g/t platinum.

Current drilling signifies that mineralization is open alongside strike and at depth, and because of the measurement of the property, Energy Nickel just lately accomplished a drill program to substantiate the historic useful resource calculation and to extend further assets in preparation of submitting a new NI 43-101 technical report for the Nisk mission.

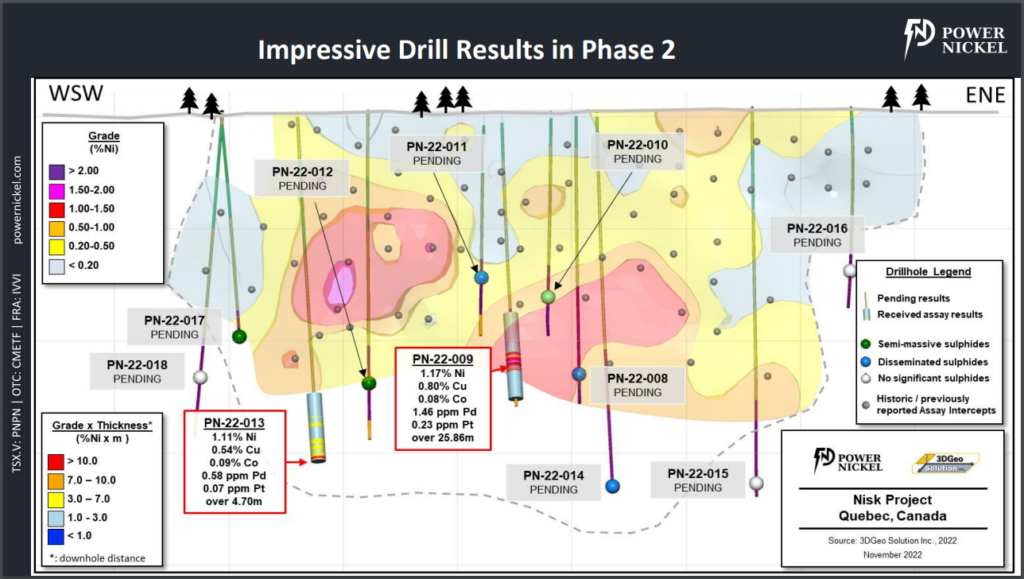

Simply final week, Energy Nickel reported the first results from its just lately accomplished 11-hole fall drill program on the Nisk Most important Zone. The outcomes are very encouraging, displaying that not solely has mineralization now been prolonged at depth by 150 metres and to the east, but in addition seems to substantiate the presence of excessive grade nickel, copper, cobalt, and platinum group minerals.

Thus far, assays have been returned for 2 holes. Highlights embrace:

- Gap PN-22-009: 1.17% nickel, 0.80% copper, 0.08% cobalt, 1.46 g/t palladium and 0.23 g/t platinum over 25.86 metres from a depth of 337.70 metres

- Together with 1.50% nickel, 0.93% copper, 0.10% cobalt, 1.85 g/t palladium and 0.36 g/t platinum over 11.00 metres

- Gap PN-22-013: 1.11% nickel, 0.54% g/t copper, 0.09% cobalt, 0.58 g/t palladium and 0.07 g/t platinum over 4.70 metres from a depth of 475.0 metres

- Together with 1.60% nickel, 0.54% copper, 0.13% cobalt, 0.65 g/t palladium and 0.06 g/t platinum over 2.50 metres

What makes these outcomes significantly important is that these holes had been drilled in an space the place no useful resource was beforehand modeled, subsequently it represents the potential for elevated tonnage for the property’s assets calculation.

Assays from 9 drill holes stay pending as of the time of writing, with drilling nonetheless ongoing. The drill program itself was carried out as a method of confirming the historic useful resource calculation, whereas on the identical time growing tonnage for a recent NI 43-101 useful resource estimate.

“The preliminary assays of our fall program are very encouraging for Energy Nickel shareholders. These holes had been drilled in an space the place no useful resource was modeled and in consequence, is not going to solely assist us higher perceive our deposit but in addition after all add substantial tonnage to our mannequin. The PN-22-009 gap specifically exhibits that there shall be stable very high-grade sections of the deposit which is able to elevate useful resource grade and enhance economics in any future mine plan. From what we’ve got seen on this drilling spherical we consider our aspiration to grow to be Canada’s subsequent Nickel mine is one thing our drill bit is popping into a really excessive likelihood end result,” commented CEO Terry Lynch upon the discharge of the outcomes.

The Administration Crew

Terry Lynch – Chief Government Officer

Mr. Lynch holds a joint honours diploma in Economics and BBA from St. Francis Xavier College. Earlier than becoming a member of Kingsmill Capital the place he suggested private and non-private early stage progress corporations, he operated and served in senior government roles with startup corporations in a variety of industries, together with industrial merchandise, oil & fuel, biotech, and media. Mr. Lynch served as a director and CEO of TSX-listed Firstgold Corp, in addition to serving as a director with plenty of different public corporations.

Peter Kent – Chairman of the Board

Mr. Kent is a industrial company lawyer with over 25 years of enterprise expertise. He previously served as Vice President, Common Counsel, and Company Secretary. with the TecSyn Group of Firms.

Greg McKenzie LL.B, MBA – Director

Mr. McKenzie earned his regulation diploma from Queen’s College and a MBA from the Ivey Enterprise Faculty at Western College. He has over 20 years of expertise as a senior funding banker with plenty of prestigious funding banking companies in New York and Toronto specializing in financing, M&A, monetary advisory, valuation, and strategic recommendation primarily to mid-cap corporations. His transactions are valued in extra of $18 billion in aggregrate throughout a broad vary of industries, together with metals & mining, industrials, client merchandise, know-how and healthcare.

Les Mallard -Director

Mr. Mallard holds a BA in Economics from the College of Prince Edward Island with a BA in Economics and has spent over 30 years within the Canadian Produce Business, serving in numerous capacities with Chiquita Canada and Chiquita Manufacturers North America. Upon retiring from Chiquita, he based Mallard Produce Options, a consulting agency centered on offering North American and Latin American purchasers enterprise options to broaden their market potential.

The Dangers

From our view the next dangers are value contemplating.

- Value of Nickel and different battery metals. Simply as nickel and base metallic costs generally is a catalyst, a possible decline in value would have a adverse influence on exploration and producer shares.

- Exploration Outcomes. If there are poor exploration outcomes reported from the mission, this might adversely have an effect on value efficiency of the inventory.

- Jurisdictional Threat. Whereas Quebec is a extremely regarded mining pleasant jurisdiction, any severe environmental points may negatively influence the mission..

- Market Sentiment. Markets can fluctuate wildly as investor expectations can change quickly relying on the 2 most typical drivers; worry and greed.

For additional potential dangers, please see the latest MD&A filed by the corporate.

The Potential Catalysts

Among the potential catalysts we see that would have a big influence on the share value embrace:

- The worth of Nickel and Cobalt. The obvious variable for any metals explorer, developer, or producer is the worth of the underlying commodity. As the costs of nickel and cobalt rise so does the online asset worth of initiatives rise, which will increase shareholder worth. We anticipate nickel and cobalt costs to rise as demand from the electrical car trade overtakes the final world industrial demand over the following decade.

- Continued mission improvement. The corporate is presently within the technique of conducting a drill program as it really works in the direction of potential manufacturing on the property.

- Development of the Electrical Car Market. The electrical car (EV) market will broaden exponentially over the approaching a long time as world governments mandate their use as a method of changing gasoline-based automobiles to scale back emissions and meet carbon targets.

- Potential future Merger and Acquisition exercise. The Deep Dive believes we’re within the early phases of a secular bull marketplace for metals. We see potential for PNPN itself to grow to be an acquisition goal by a bigger entity seeking to broaden into nickel, cobalt and different battery metals because the property continues to be developed.

- Provide of Nickel. The availability of nickel has declined in recent times as mines have depleted reserves and never very many new mines have come on stream, or are even within the pipeline. Demand by the electrical car trade has despatched explorers looking for to seek out new deposits to fill the rising demand.

In Conclusion

On the Deep Dive, we just like the macro prospects for nickel and different battery metals, and the underlying fundamentals would recommend we’re within the early phases of a battery metals bull market. We particularly like initiatives in secure, mining pleasant jurisdictions. Nickel is benefiting from the recovering post-pandemic financial system in addition to extraordinary demand from the EV trade that’s anticipated to devour 60% of obtainable provide by 2030. This could bode properly for nickel and different battery metals as different industries compete for his or her provides.

We view Energy Nickel as an attention-grabbing scenario because of its potential high-purity Class-1 nickel mission in Quebec, which is aiming to grow to be a number one hub for EV and battery manufacturing, which is able to search domestically (and extra importantly, domestically)-sourced uncooked supplies. In the meantime the pending spinout of Consolidation Gold & Copper may present a price add for shareholders.

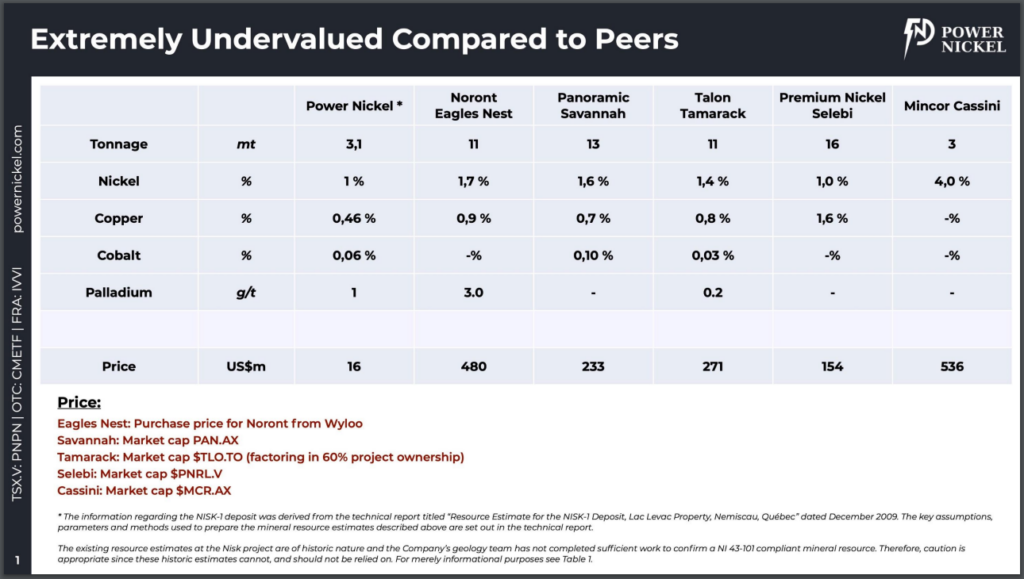

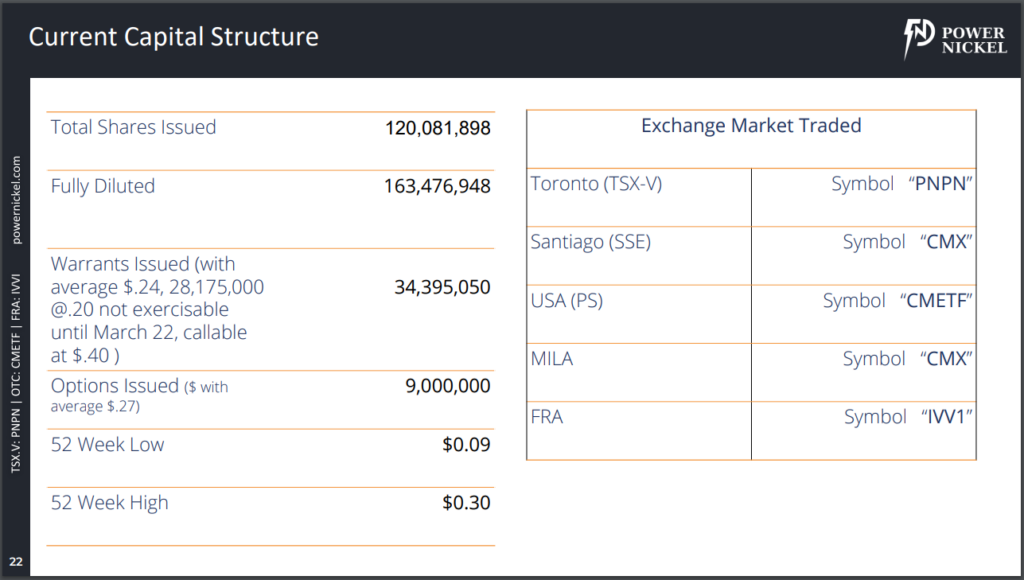

With 120.1 million shares excellent and a market capitalization of $19.69 million, Energy Nickel is in a fantastic place to proceed to advance the Nisk mission into doubtlessly turning into Canada’s subsequent nickel mine and grow to be a provider of Class-1 nickel to North America’s EV battery producers.

FULL DISCLOSURE: Energy Nickel is a shopper of Canacom Group, the father or mother firm of The Deep Dive. The writer has been compensated to cowl Energy Nickel on The Deep Dive, with The Deep Dive having full editorial management. Not a advice to purchase or promote. We could purchase or promote securities within the firm at any time. At all times do further analysis and seek the advice of knowledgeable earlier than buying a safety.